Examining Angler Gaming and Two European Penny Stocks Together

In London, the European financial markets have shown renewed vigor as the pan-European STOXX Europe 600 Index climbed by 1.18%. This upward movement is attributed to easing trade tensions between major economies and growing optimism regarding potential reductions in U.S. interest rates. Key indices such as France’s CAC 40 and Germany’s DAX have similarly benefited from this positive momentum.

Against this backdrop of cautious optimism, market analysts suggest that investors broaden their focus beyond well-established equities to include penny stocks, which are often overlooked despite their potential for substantial returns. Penny stocks, typically characterized by lower market capitalization and share prices, represent emerging or smaller companies that may thrive in a recovering market environment.

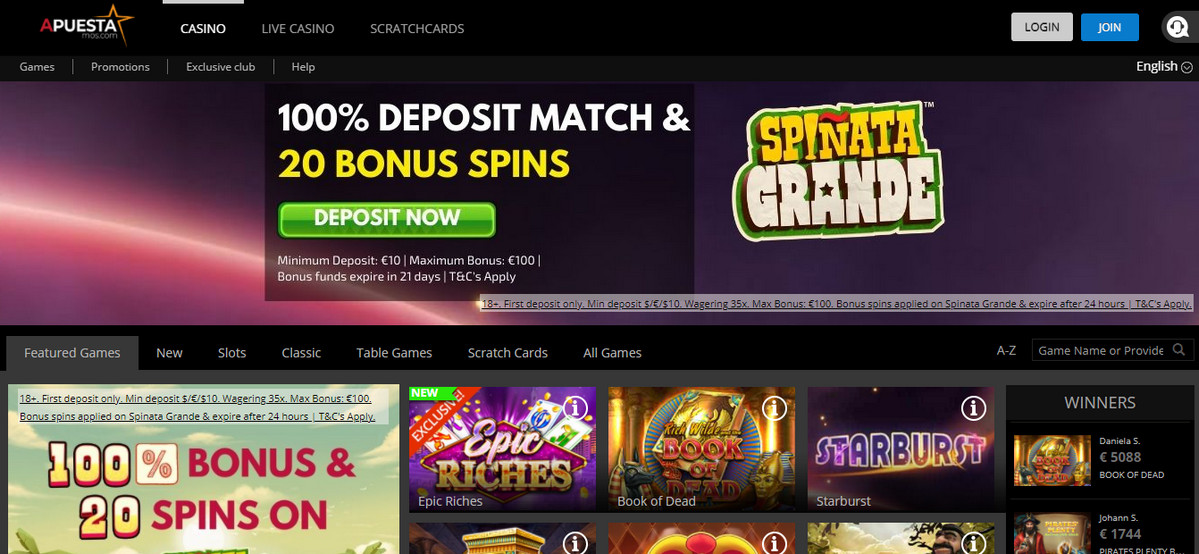

Among these, Angler Gaming, a lesser-known European company, has attracted attention due to its innovative business model and recent performance indicators. Financial experts highlight that alongside Angler Gaming, two other European penny stocks present compelling investment opportunities, warranting thorough analysis for portfolio diversification.

Dr. Emily Carter, a senior market strategist at the London Financial Institute, commented, ‘While penny stocks carry inherent risks, the current market conditions and easing geopolitical pressures create a fertile ground for selective investments in this segment. Angler Gaming and similar companies could offer investors an advantageous entry point into the European market’s growth trajectory.’

Investors are advised to conduct comprehensive due diligence and consider the volatility associated with penny stocks. However, with the European market poised for continued recovery, these opportunities might prove valuable for those seeking to capitalize on emerging trends beyond mainstream equities.